What is Systematic Investment Plan (SIP)

Systematic Investment Plans are the abbreviation of SIP, it is an investment strategy wherever associate degree capitalist do the investment to create up their wealth over a protracted amount of your time and the SIP calculator will help you in calculating the total amount that you have earned from your investment. During this style of investment, a hard and fast quantity is invested with for over a selected amount of your time at a regular interval.

It helps chiefly in 2 ways;

• Rupee value averaging

The concept of rupee value averaging lies within the averaging place of the value at that you get the units of the fund. The share has perpetually been volatile that reflects the ups and downs of the economy.

If we tend to recall the law of demand, wherever the costs of products are high once there is a lot of demand for that product within the market. So, this issue follows a similar rule. It guides the capitalist to “buy-low and sell-high”. It means, buys a lot of units of mutual once the worth is low and sell it within the time of inflation.

- Compounding

Compounding is that method during which asset earnings, from either capital gains or interests. This development is additionally called interest and it works on each asset and liabilities.

In compounding, the quicker you start investing, the faster you can see the compounding impact.

Let’s assume, if you start investing from your 30th birthday, 1000 months, you would have put aside Rs 3.6 lakhs in the next 30 years. If that investment earns an average of 10%, it would become 22.8 lakh in the next 30 years when you will reach the age of 60 years.

Let’s assume, if you start investing from your 30th birthday, 1000 months, you would have put aside Rs 3.6 lakhs in the next 30 years. If that investment earns an average of 10%, it would become 22.8 lakh in the next 30 years when you will reach the age of 60 years.

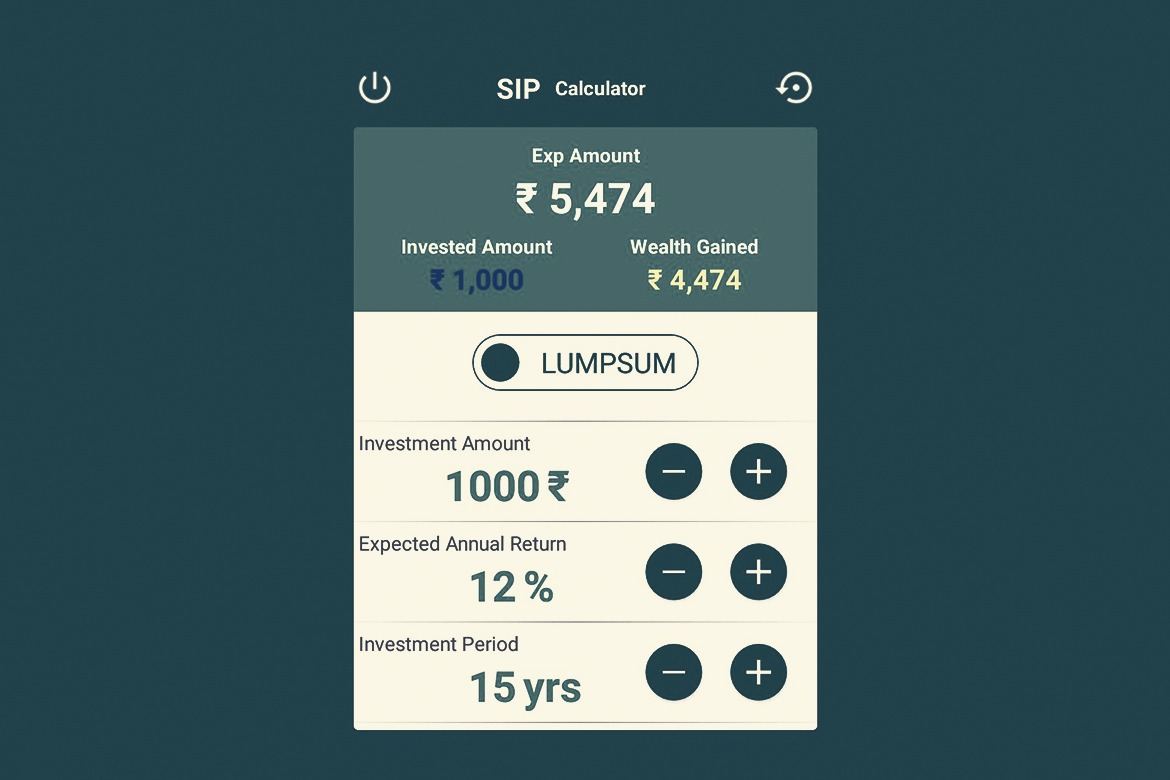

What is the SIP calculator?

With the SIP calculator, you can calculate the total return value after completing the maturity period of your investment. SIP calculator is an online tool which enables the capitalist to make a proper and informed investment decision. With the help of this calculator, you can plan the important decisions of your life regarding financial goals like buying a new car, weddings, buying a house, etc.

You just have to follow some simple steps like entering your quantity of the investment per month, tenure of the investment, number of SIP payments and expected annual returns

Let’s see how you will calculate your SIP, in detail;

• Investment quantity per month-The investment quantity per month is that the quantity which will be invested with each month. it’s a hard and fast quantity. as an example, if a sip is of rupees ten,000 per month is mounted then the calculator can assume that each month at the quantity of rupees ten thousand are invested with within the given fund.

• The total variety of payments-The total variety of payments means that the term fund sip; the full variety of payments you’re getting to invest in a very SIP.as an example, you’re selecting forty-eight payments it means that you’re getting to invest a specific amount for four years each month.

• Expected Annual come back-Annual comeback means that the investors expect a return from their investment every year. but it’s insufferable to grasp the precise come back however only for a reference, we will use the proportion of the past return. The fluctuation is often there in numbers simply to envision the full price in numerous state of affairs.