The digital payment ecosystem is expanding at an exponential rate in India. First, demonetisation made the digital payment base wider and then pandemic gave a spur to it. India’s digital payments industry is expected to grow from Rs 2,153 trillion to Rs 7,092 trillion by 2025 at a compound annual growth rate (CAGR) of 27%.

Banks provide us with multiple modes of transactions. Today in this article we will know about the various online payment methods used in India.

National Electronic Funds Transfer (NEFT):

National Electronic Funds Transfer (NEFT) is one of the major electronic funds transfer systems in the country. It was started in November 2005. National Electronic Funds Transfer (NEFT) is a nationwide payment system. Under this scheme, individual, firm and corporate entity/organization can transfer funds from any bank branch to any individual, firm or corporate entity/ organization having an account with any other bank branch established in any corner of the country. There is no limit to the minimum or maximum amount that can be transferred through NEFT. Earlier, payments were cleared in batches every 30 minutes. In accordance with the new RBI guidelines, the NEFT facility is available 24×7 now. NEFT monitoring body in Reserve Bank of India.

Real-Time Gross Settlement (RTGS):

RTGS means real Time Gross Settlement of Individual Fund Transfer on an order basis without any netting. Real-Time means that not at that point in time but after some time, Gross Settlement means that the funds transfer instructions are settled on an instruction basis. Generally, the beneficiary branches are expected to receive the funds in real-time as soon as they are transferred by the remitting bank. The beneficiary bank has to credit the beneficiary’s account within 30 minutes of receiving the fund transfer message. The RTGS system is basically meant for large scale transactions. The minimum amount to be transferred through RTGS is Rs 2 lakh. However, there is no upper limit on RTGS transactions. Like NEFT, this is also managed by RBI.

Also read: Using A Credit Card? Follow These 5 Tips To Make Your Transactions Safer And Prudent

Immediate Payment Service (IMPS):

IMPS is a real time payment service that can be used throughout the day including holidays. The service is provided by the National Payments Corporation of India (NPCI) which provides customers with the option to transfer money instantly through banks and RBI authorized Prepaid Payment Instrument (PPIs) issuers. PPIs are payment instruments that facilitate the purchase of goods and services, including financial services, remittance facilities, against the value stored on such instruments. According to the NPCI website, people who are not connected with banks can also send money through IMPS through PPIs. However, the fee for transfer through IMPS is decided by the individual member banks and PPIs.

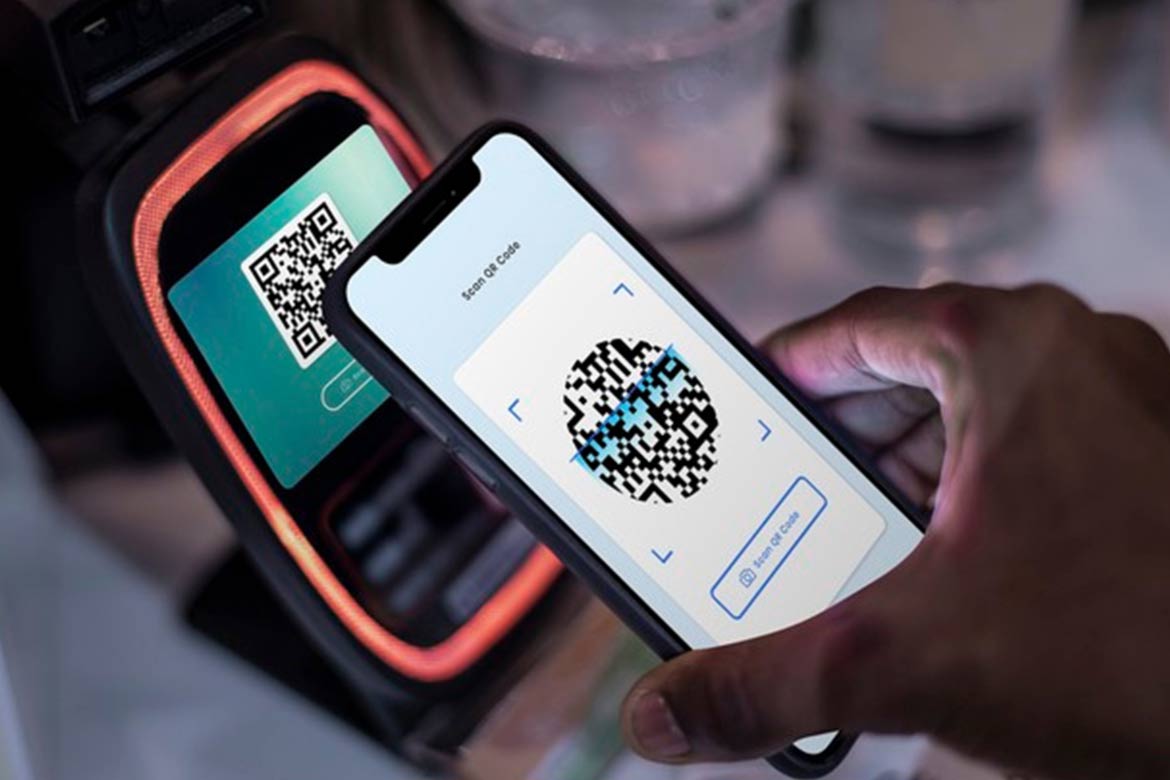

Unified Payment Interface(UPI):

It is an improved version of Immediate Payment Service (IMPS) which is around the clock money transfer service to make cashless payments faster and easier. UPI is a system that enables multiple bank accounts through a single mobile application (of any participating bank), multiple banking facilities, seamless fund routing and merchant payments. Presently UPI is the largest among the systems operated by the National Payment Corporation of India (NPCI) including National Automated Clearing House (NACH), Immediate Payment Service (IMPS), Aadhaar Enabled Payment System (AePS), Bharat Bill Payment System (BBPS), RuPay etc.

Read more: Digital Pocket Money: What Are The Prepaid Cards For Children? Why These Cards Are Better Than Cash?

According to NPCI data, the value of transactions done using UPI crossed US$ 100 billion in a month for the first time in October, 2021, further cementing India’s position as the most popular digital payment system.

Aadhar Enabled Payment System (AePS):

AePS is an Aadhaar-based payment system. By which inter-financial banking transaction inclusion is easily done. It has been developed by NPCI (National Payment Corporation of India) in consultation with the Reserve Bank of India and member banks. Its purpose is to provide banking services in unbanked and remote areas. Now customers do not need to go to the bank to withdraw money and make deposits. With just Aadhar number, their basic banking needs gets completed at home or near home. This Aadhaar-Based Payment System has proved to be a boon for the people of remote areas. It is done with the help of a Bank Correspondent. Bank BC has a Micro ATM / PoS machine with which the biometric device is connected. The customer enters his Aadhaar number and certifies the identity either by thumb or by using a photograph of the iris of the eye by stating the deposit/withdrawal amount. Once the identity is confirmed, the transaction is completed.

1 comment

I love banking