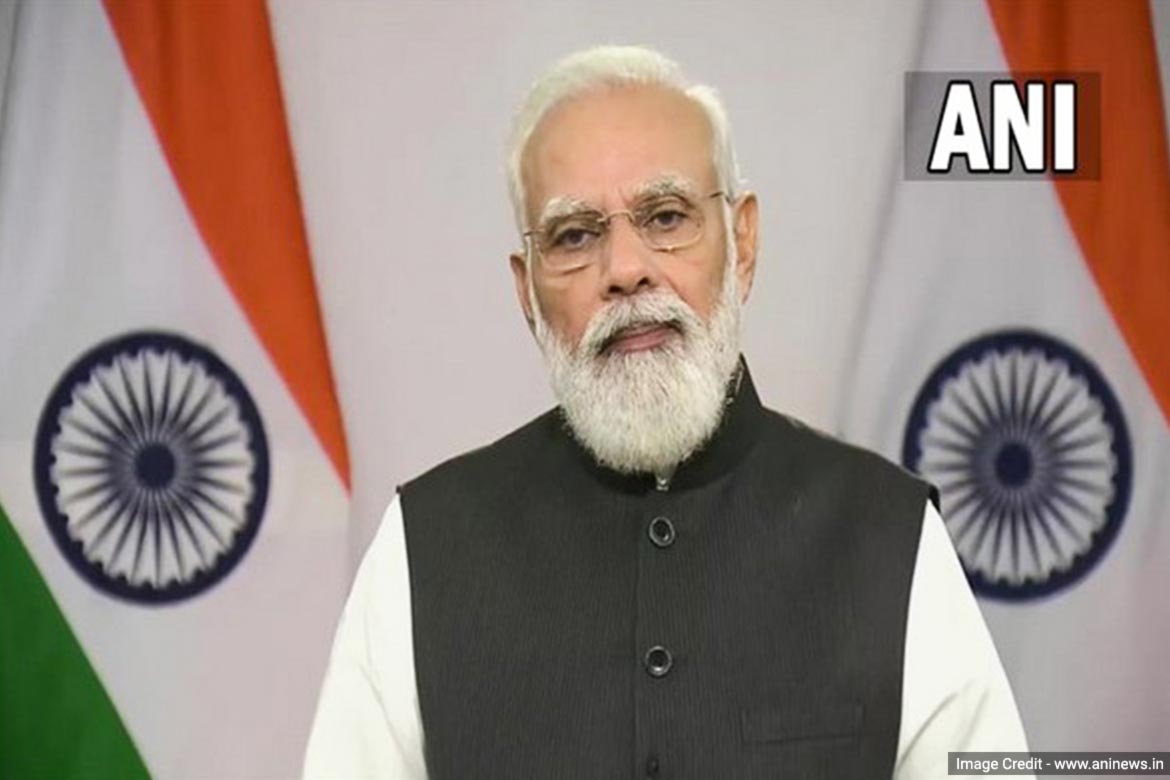

Prime Minister Narendra Modi has launched the Reserve Bank’s Retail Direct Scheme. This scheme is for retail investors. Retail investors can buy and sell government bonds online through this. This scheme was announced in the monetary policy of February 2021. To buy and sell Government Securities, one has to directly visit rbiretaildirect.org.in

What is the Retail Direct Scheme?

The Reserve Bank’s Retail Direct Scheme allows retail investors to buy Government Securities (G-Secs) online from both the primary and secondary markets. Small investors can now trade in government bonds by opening a gilt security account through it. This account has to be opened with the Reserve Bank. This account will be called Retail Direct Gilt (RDG) account.

Are you eligible to open an RDG account?

As per the RBI notification dated July 12, 2021, a retail investor can open an RDG account. For this, he has to follow some rules. One has to maintain a Savings Bank Account in India. Applicant must have a PAN card for Income Tax, Aadhar ID, Voter ID or any official for KYC. Moreover, one has to provide an email ID and registered mobile number.

RDG accounts can be opened in your own name or with any other retail investor. But the other investor also has to follow all the rules.

Also read: Recent Bank Mergers Happening in the World Due to Economic Issues

How to register online?

The investor can register on the portal by filling the online form. For this, he will get OTP on email and mobile phone. After registration, the Retail Direct Gilt account will be opened and all the passwords will be given through SMS or email.

Buy and sell in the primary and secondary market

Once the account is opened, the retail investor can buy government securities from the primary market. He will be able to buy only when the government issues any bonds. The investor can then sell or buy these bonds in the secondary market. Only one bid will be allowed for one bond. When the investor submits the bid by purchasing the securities, he will be asked for the full amount.

No maintenance charges

According to the Reserve Bank, there will be no charge for the RDG account. There will be neither an opening charge nor any maintenance charge. However, if there is any charge for gateway payment, then the investor will have to pay that charge. You can take account statements from the online portal. You will also get all the records of the transactions. You can also see the number of securities in your account.

Provision for nominees

Investor can have a maximum of two nominees. That is, if the customer dies, the securities will be transferred to the nominee. For this, the nominee will have to provide the death certificate and transmission form.

Loan can be raised against G-sec

A retail investor can also take a loan against securities from an RDG account. If an investor wishes he can also gift these securities to any other retail investor. Any complaint related to this can be made on the portal itself. This is the first time in India that this option has been given to retail investors to easily and directly buy government securities.

1 comment

Yes I can do it