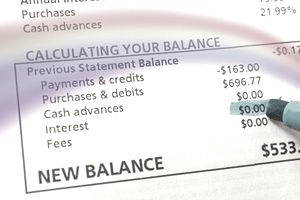

Finance Charge is the charge which we have to pay as an amount of interest in the context of credit card debt. Your credit card billing statement always has a mention of Finance Charge (provided it is due to your account), in those cases, you need not calculate it. But a prior knowledge on how to calculate it comes in handy if you wish to calculate in advance for the credit card balance in your mind. It also helps in cross verification of finance charges levied by the credit card company.

Three Figures Are Critical To Its Calculation:

- Credit Card (or Loan) Balance

- APR (Annual Percentage Rate)nd

- The length of the billing cycle.

A Simple Way To Calculate Finance Charges

Balance X monthly rate

Illustration:

- There are 12 billing cycles per year, with each unit billing cycle of one-month duration. You have a USD 500 credit card balance with an 18% APR.

- Calculate the periodic rate by dividing the APR by the number of billing cycles in a year, i.e. 12 in the current case.

- Do take care to convert percentages to a decimal.

- The periodic rate is: [ .18 / 12 = 0.015 or 1.5% ]

- The monthly finance charge is: [ 500 X .015 = $7.50 ].

Finance Charge is lower in the above example as compared to the balance and interest rate both of which are the same. It happens because you are paying interest for lesser days, 25 v/s 31. The total annual finance charges that you have to pay would end up almost the same.

Variations in Credit Card Issuer’s Finance Charge Calculation Methods

The above examples are one of the simple methods for finance charge calculation, but it may not be the one being used for your billing statement. It is because the creditors may use one of the five other finance charge calculation methods available that take into consideration the account transactions made on your credit card in the current and previous billing cycle.

The backside of your credit card statement will reveal to you the method being used out of all five.

Read More: Wanna Know About Bank Holiday? Then Read It.