If you want to go for a financial services career, then this article is for you. Here, we will provide you some relevant information regarding why should you opt for the same and if you’re choosing it then what benefits will it bring to you. This career helps you in managing your interest rates which automatically provides you a better platform to invest more. A career in finance will help put you in the heart of money management.

These are Benjamin Franklin’s words: An investment in knowledge pays the one best interest”.

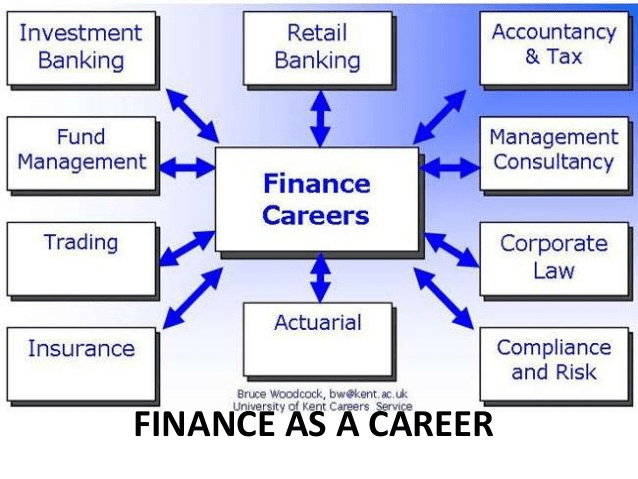

Financial Services have an extensive range of services like:

- Money Management in businesses including credit unions

- Banks

- Credit Card Companies

- Accountancy Companies

- Stock Brokerages

- Investment Funds and

- Much More.

Why go for a Financial Services Career

The world cannot function without money. And if you are a finance professional then you can find yourself at the nucleus of money management. It is both a challenging and dynamic career path. Financial Services have a major contribution to India’s growth. It contributes about 6% by way of rising in employment and the revenue it generates. Banks and Insurance employ most of the finance professionals in the Indian Economy.

A Finance professional needs to have a finance degree and an MBA with a specialization in Finance which will pave your way to a successful career in Finance Industry. India has no dearth of people willing to make a career in Finance and a simple Google Search with Keyword Finance Institutes in India will show an endless list of Institutes to fulfill your needs.

6 Financial Jobs One Should Consider

- Investment Banker

He/She is an individual that works for an investment bank like:

- Goldman Sachs

- Morgan Stanley

- JPMorgan Chase and many other institutions

Their job is to raise capitals for:

- Individuals

- Companies and

- Government

They also play a crucial role in mergers and acquisitions by serving as a facilitator between a company and its investors, assisting both unique investment opportunities like:

- Derivatives and

- Pricing financial instruments.

They are the topmost ones when it comes to remuneration in the finance industry.

And below are the rest professions in the Finance Industry, the list is not limited:

- Financial Analyst

- Venture Capital Analyst

- Chief Financial Officer

- Portfolio Manager and

- Risk Analyst.

So, here we provided you the big scope of the finance industry which will help you to choose your career in finance.