In today’s lifetime, we get all kinds of loan which will provide us with a platform to achieve the things we need in our life. Like, if we feel the need of a car then we’ll get it by applying for the loan and if we want to get more education then we can apply for the educational loan. By applying for the loan, we’ll get sufficient money to cover our needs. Later on, this amount of money will be paid as the instalments with the adding amount of interest.

Loans do contribute, when it comes to making our life easy, be it the: Personal one or the Professional one. They do so, by giving us the financial leverage that extends beyond our earnings. It could be a:

- Credit Card

- Personal Loan or

- Auto Loan etc.

Lenders extend credit provided borrowers fulfill certain key parameters. In India, loans are easy to get, for those with a good credit score, as compared to those who don’t have much, when it comes to collaterals.

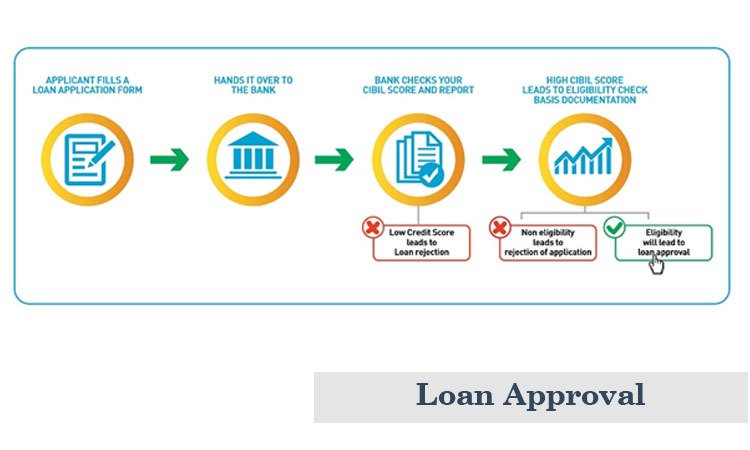

While you apply for a loan, banks check your CIBIL (Credit Information Bureau (India) Limited), score to get a good and detailed idea about your creditworthiness. The borrowers who have a good CIBIL score are in a better position when it comes to the chances of their loan application getting approved.

79% of credit cards or loans are approved for individuals, who have a greater than 750 CIBIL score.

What Do Banks Broadly Check?

- CIBIL Score and Report: It is one of the crucial factors affecting the loan approval process. Those with a good credit score and report, reportedly have good credit health.

- Employment Status: Apart from a good credit history, lenders also look for steady income and current employment status, while going through your loan application.

- Account Details: Written off cases or Pending cases are also given special importance by lenders.

- Payment History: Lenders are also on a lookout for any payment defaults or amount overdue in your past, that may seem to play a negative role during the compilation of your overall financial health report.

- EMI To Income Ratio: Banks also give strong consideration to the proportion of your existing loans in comparison to your salary at the time of loan application. You have ample chances of your loan approval getting reduced if your total EMI’s exceed your monthly salary by 50%.

So, keep all these things in mind while applying for the loan as this not only grow your value among the banks but also makes bank to provide you with any kind of loan.