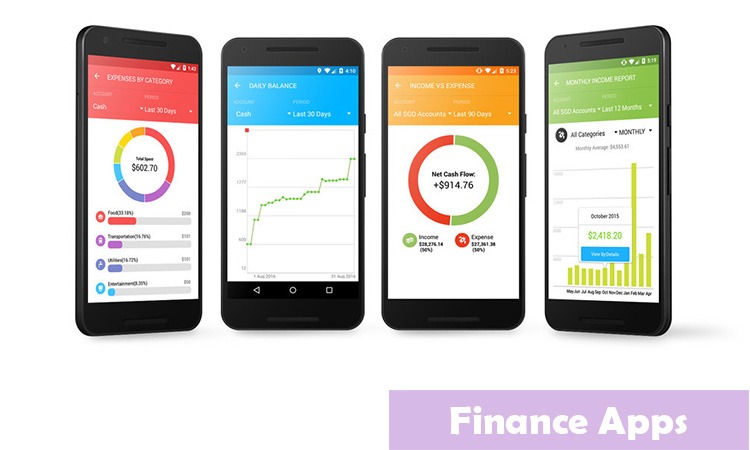

In this era of technology, we get all the things in our hands through installed apps in our mobile phones. We have apps almost from all fields like cooking, entertaining, net banking, and finance also. Through these apps, we make our work easy and fast. In this article, you are provided some finance apps and the work they do. So, read it entirely to make your money management easy with security.

What can a finance app do

- Managing money

- Sticking to a budget

- Handling Investment decisions

All become easier with the use of personal finance apps.

Below we are discussing few Finance Apps

- Mint: Best app for money management

Mint App: It is provided by Intuit Inc. the developer behind QuickBooks and TurboTax.

This app is an all in one and effective solution for:

- Budget Creation

- Keep a track on your spendings and

- Help Make you smart decisions when it comes to your money.

You can connect all your bank and credit card accounts, along with the monthly bills to enable you to see all your finances in one convenient place without any hassle of multiple logins at different sites.

This app tells you about due bills. Sends you payment reminders to avoid incurring late payment charges. Based on your spending habits, it offers various pieces of advice on how to keep better control of your budget. You get a free credit score as a bonus that too in real-time. It also tells you how much money you have across multiple accounts and cards without much hassle.

- Wally: The best app to keep a track on your expenses

If you like things to be in your control i.e. organized with the help of personal expense tracking app, then this is the best option available. Instead of entering your expenses manually every now and then. It lets you take a photo of your receipts and retrieve data from it.

It is a clean and streamlined app that is extremely convenient and easy to use. It helps you have a good insight into your money outflows.

To summarise, there are a lot of more apps in the market both paid and free that help you manage your finances in a better and effective way.

Read More: Manage Your Credit Cards With Ease! Try These Credit Card Apps Now!