If you are a credit card holder then you must be aware of the term Credit Card Balance. But my question is What Impact does Credit Card Score have?

What does one mean by Credit Card Balance & the Information it disperses

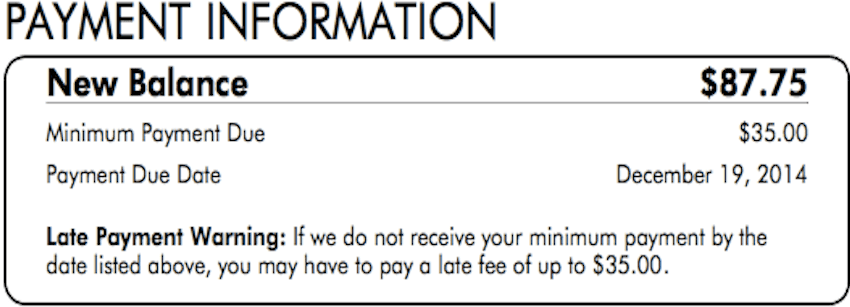

It is the amount of money that a credit card owner owes to the credit card issuing company. Latest Credit Card Balance takes a max of 24 hours to update, depending on the payment method used and average time credit card issuing company’s systems take to process the payment i.e. credit the payment to credit card owner’s account.

Balance can be:

- Positive

- Negative Or

- Zero

Depending on the fact:

- That whether still, some dues are pending to be cleared

- Excess payment has been made or

- The only due amount was cleared i.e. payment was in such a manner that there is no or zero outstanding in the current.

Its effects on Credit Card Score

- If the card owner has a history of:

- Making excess payment for his/her credit card bills or

- Clearing all dues in full i.e. no outstanding for every credit card bill

Then, this will reflect positively on their credit score and benefit them in future applications for approval of a loan application or getting an additional credit card issued.

2. If the card owner has a history of outstanding credit card dues, then this will reflect negatively on his/her credit score and lead to rejection of his/her applications for loan approval and credit card issuance.

To conclude, Credit Card Balance is a figure that informs the credit owner about:

- Whether he/she has any pending dues to be cleared

- Has made an excess payment to the bank

- All dues are cleared i.e no outstanding as off date &

- More importantly, has an appreciating or degrading effect on his/her credit score.